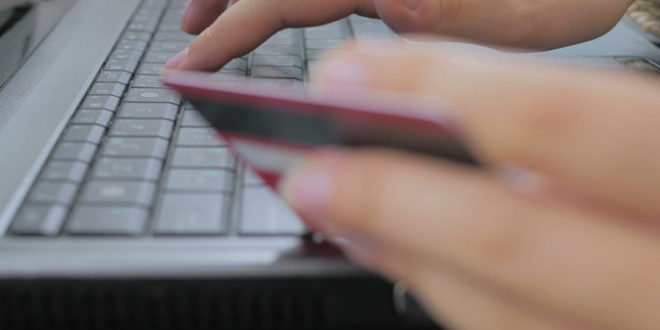

SOUTHLAKE, Texas – In an effort to increase acceptance of virtual payments by buyers and suppliers, Sabre Corporation and its partner Conferma have integrated the Sabre Virtual Payment solution for air tickets into the Sabre Red Workspace, used by over 425,000 agents around the world.

An industry first, the enhanced digital payment capability is offered as a new standard form of payment, giving agents the ability to generate virtual cards as part of existing ticketing and payment processes. The new payment method will be listed alongside credit cards, cash or check options, providing flexibility within a seamless payment process for the agency, corporation and the traveller. It also eliminates the need for mid/back office providers and online corporate booking tools such as GetThere to modify their business processes and incur additional technical expenses.

“The new black” for air ticketing payments, Sabre Virtual Payments gives agents the option to set credit limits, apply date restrictions and define merchant categories – a set of controls that help agents to pay more efficiently while reducing the risk of fraud. Sabre’s Virtual Payment can be used at time of ticketing, refunding and exchanging, and it can be stored in customers’ preferences through the Sabre Profiles capability.

“For each air ticket, the traditional forms of payment challenge travel agents with high risk of fraud, exposing corporate accounts and requiring extra time for reconciliation. A more secure and efficient way to pay is now available for Sabre-connected agencies, and it is part of the core reservation flow in the Sabre Red Workspace and Sabre APIs,” said Neil Fyfe, vice president of Virtual Payments at Sabre. “In addition when using virtual payments within the GetThere booking tool, we provide incremental detailed reconciliation data available for expense management.”

According to recent research from PYMNTS.com, instances of fraud grew 127% between 2015 and 2016, and every year businesses lose approximately US$3.5 trillion to fraudsters. The reach of fraud attacks has grown substantially from the start of 2015, when less than $2 out of every $100 was subject to a fraud attack. In Q1 2016, the reach of fraud attacks climbed to affect more than $7 out of every $100.

With this enhancement to the agency point of sale, Sabre is the only virtual payment provider with global core system integration for network, hybrid and low-cost airlines, offering accounts to both the agency and corporation with multi-bank and multi-funding options. Sabre has seen strong pick up in travel agencies and corporations using virtual cards, with the year over year growth of 130%. By incorporating its virtual payment solution for air into its agency workflow, the company expects continued growth in 2017.

Any time a country or region imposes any sort of visa stipulation – even if it’s a waiver – the travel industry sighs a collective groan, knowing the obstacles and headaches to come.

You can read more of the news on source

Travelsmart

Travelsmart